Understanding the nuances of travel credit cards is not just a savvy financial move – it’s the key to unlocking a world of seamless adventures, upgraded experiences, and passport stamps that tell tales of strategic financial prowess.

Of course, understanding these cards isn’t always easy, but the bottom line is the same for many of us who have them. As travelers, we want rewards, we want discounts, we want miles, and we want our travel credit cards to be worth it.

According to a study completed by Wells Fargo, 71% of Americans have a credit card that offers rewards, and 65% claim that they care about their rewards more than ever…. Join us as we dissect individual travel cards, separating the exceptional from the ordinary, to ensure your wallet is not just a carrier of cash but a ticket to wanderlust indulgence.

Key Takeaways:

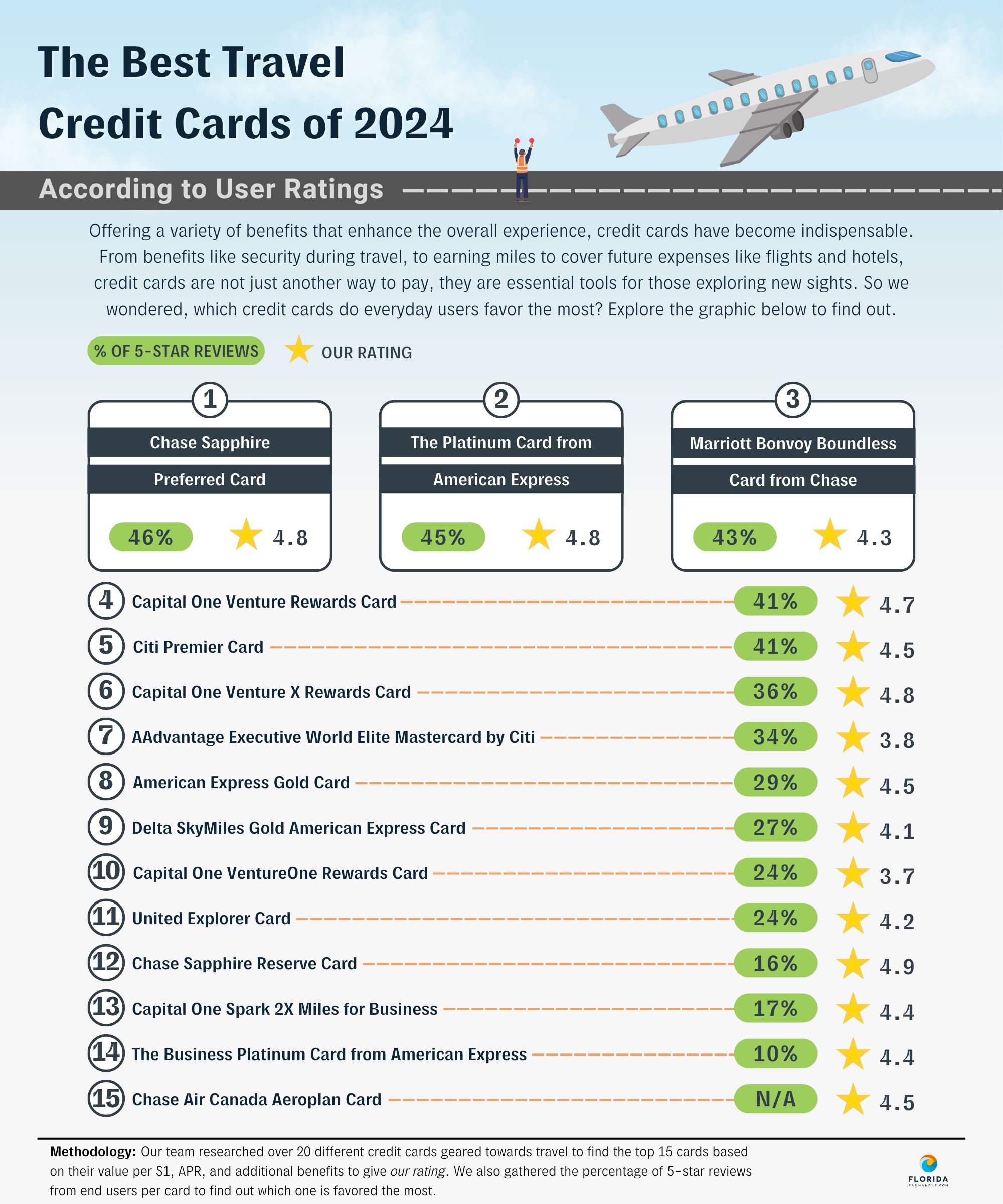

- Chase Sapphire Preferred Card is top-rated among consumers. 46% of the reviews gave it 5 stars. Only 5% rated it as 1-star.

- Chase Sapphire Reserve is the top-ranked credit card geared towards travel. While the annual fee is $550, it manages to pay itself off rather quickly. You get 10x points on hotels, 5x points on flights, 3x points on dining, and the APR hovers around 22%-29%.

- Capital One Venture X Rewards Credit Card has split consumer reviews. While it’s officially ranked as number 2 because of the benefits it provides, 24% of users gave it a 1-star review and 36% of users gave it a 5-star review.

Chase Sapphire Preferred: Rated Highly According to Customers

Before we dig into our official rankings of each travel card, we took the time to dig into each card’s consumer reviews. Chase and Capital One are two companies that had the most reviewed credit cards with travel perks across the board.

Among the most reviewed, the Chase Sapphire Preferred Card is the highest-rated travel credit card among consumers. 46% of reviews rated this card 5 stars, 24% gave it 4 stars, and only 5% at one star. Reviews state that this travel card is great for those who “…travel frequently but not enough to pay the enormous annual fees that some luxury travel cards charge…”

One of our 15 top-ranked cards is hit or miss with general consumers. 34% of the Capital One Venture X Rewards Credit Card reviews rated this card 1 star, the other 36% at 5 stars. According to a Reddit forum, an overwhelming amount of users claim that ” …there’s no downside even if you don’t use any of the other benefits” and “…it’s the best bang for your buck premium travel card.” Some of the negative customer reviews state “The travel portal is a total waste of time” and “I’ve had 3 trips where hotel did not have record of pre-book through Capital One Travel. Major headache to deal with while on vacation. Not worth the hassle.”

Here are 2024’s Top Travel Credit Cards Ranked…

Let’s dive straight into it. At number one, Chase Sapphire Reserve has taken the top spot. From the data we gathered, we found that the APR, average rating of rewards, and the additional perks were the most vital to be taken into account.

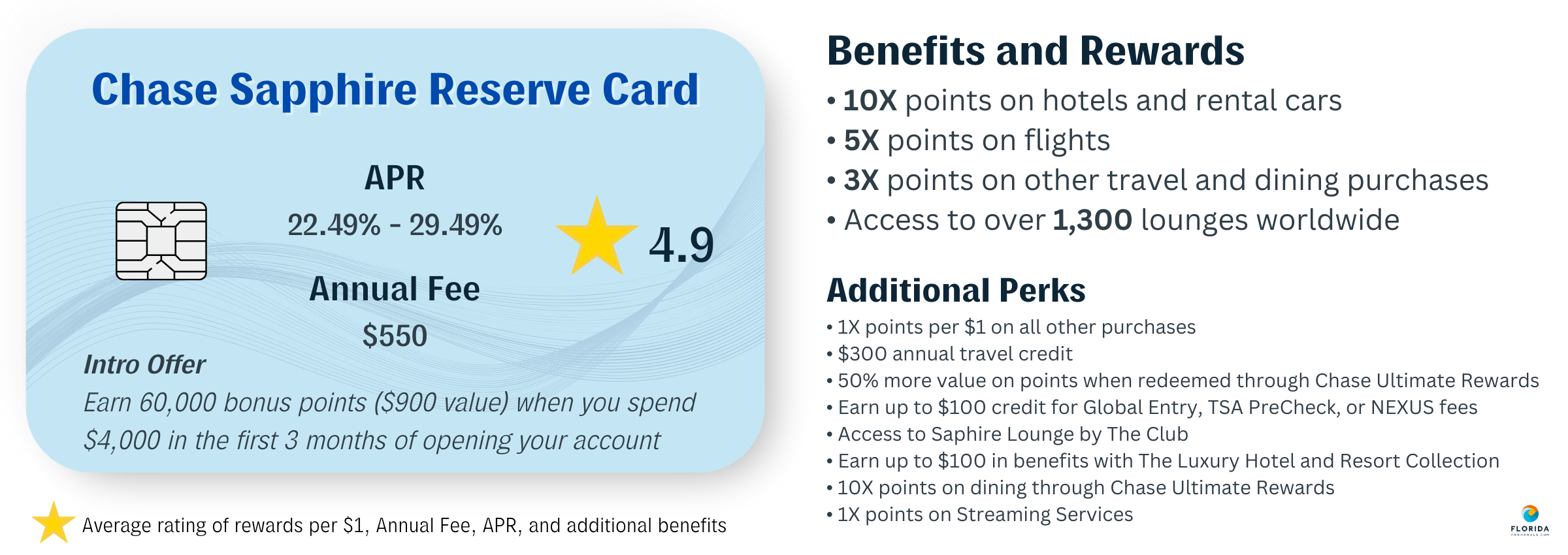

1. Chase Sapphire Reserve

Minimum Credit Needed: 700+

Right out the gate, Chase Sapphire Reserve is an elite travel card with an attractive intro offer and rewards like annual travel credit, and access to high-quality lounges worldwide. While the fee may be higher than others, the benefits outweigh the cons and there are a myriad of ways you can put your rewards to use.

Submit Your Review for This Travel Card

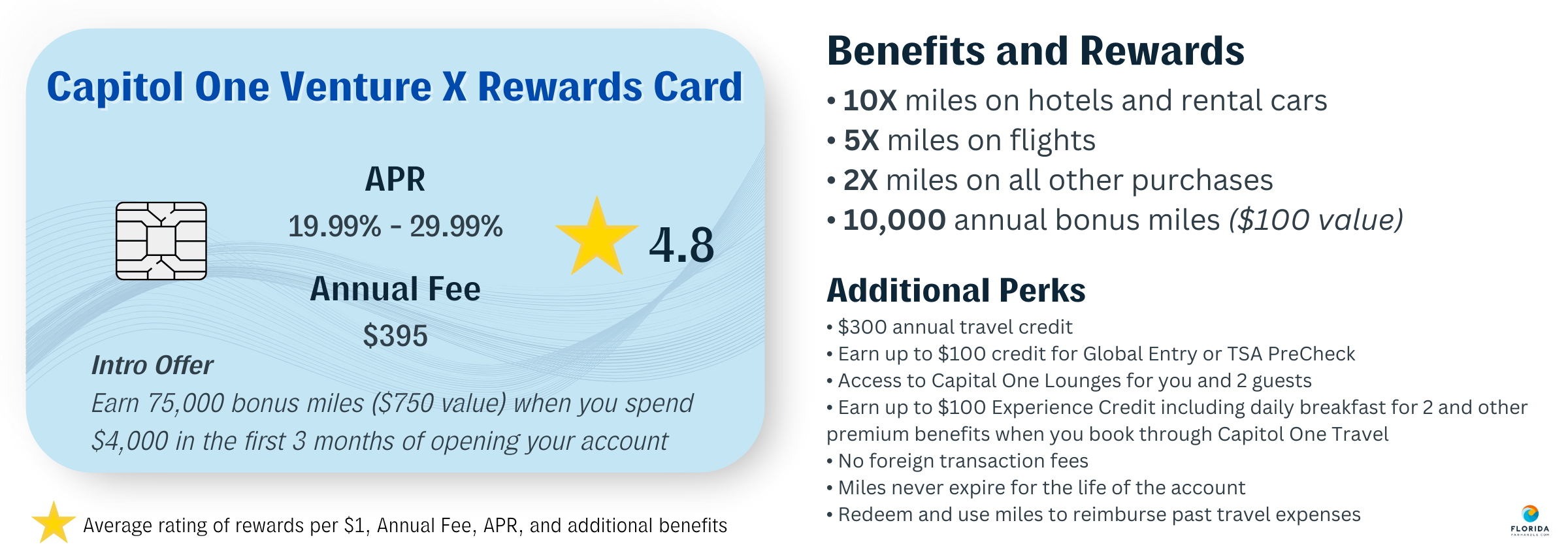

2. Capital One Venture X Rewards Credit Card

Minimum Credit Needed: 700+

Capital One Venture X is similar to the Chase Sapphire Reserve in a few different ways. It also offers an initial intro offer, as well as an annual travel credit. Additional perks are no foreign transaction fees and miles that never expire. The annual fee is also less than the Chase Sapphire Reserve Card. Something you don’t get, however, is the access to over 1,000 lounges.

Submit Your Review for This Travel Card

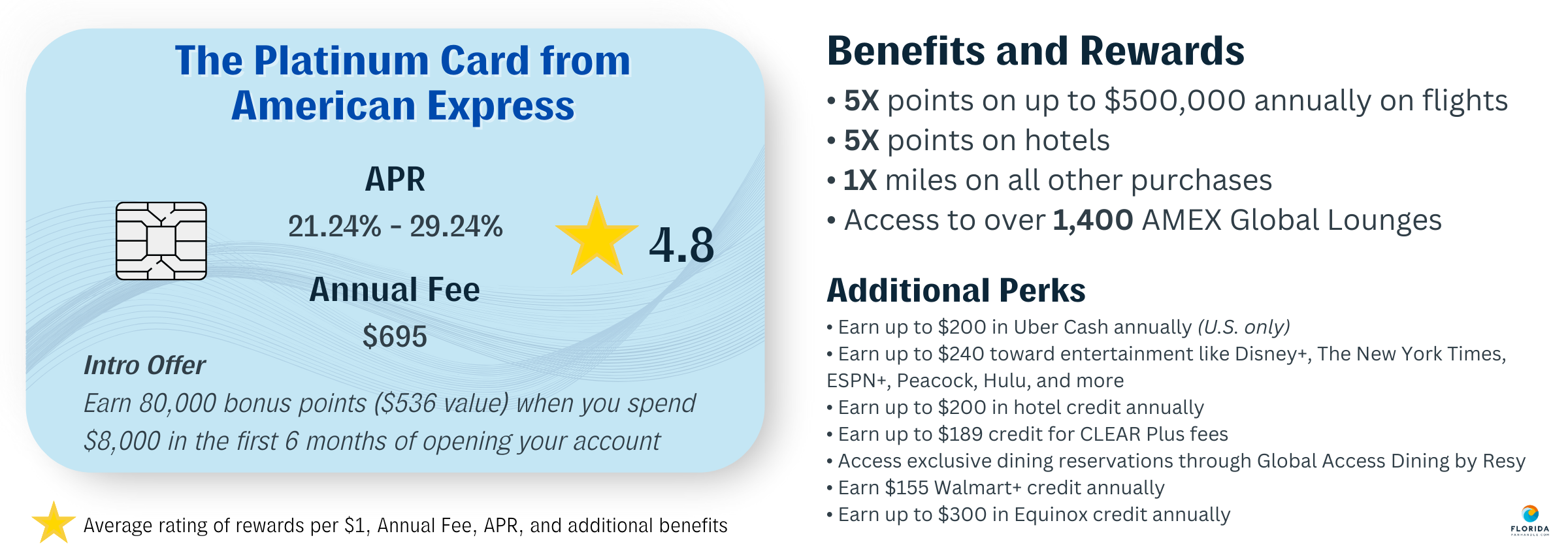

3. The Platinum Card from American Express

Minimum Credit Needed: 690+

The Platinum Card from Amex is one that is rated somewhat highly amongst consumers. It also is a popular travel card that many people have, but its annual fee is a bit higher than the others. Perks that you can enjoy are additions to Uber cash or rewards towards streaming services. If you use these credits and find them more useful, having this card could work in your favor.

Submit Your Review for This Travel Card

4. Chase Sapphire Preferred Card

Minimum Credit Needed: 690+

Different from the Reserve card, the Chase Sapphire Preferred Card is generally for people who travel on occasion but don’t spend as much as a Reserve user would. Additionally, the intro bonus this card offers can cover around 6+ years of membership fees.

Submit Your Review for This Travel Card

5. Capital One Venture Rewards Credit Card

Minimum Credit Needed: 670+

If transferring your miles sounds like the better fit, then Capital One Venture might be the best choice for you. Not only do you receive access to all U.S. Capital One Lounges, and no limit on how much you can earn, but you can also redeem your miles for past travel expenses. The cons would be that the cashback isn’t as high as similar cards.

Submit Your Review for This Travel Card

6. American Express Gold Card

Minimum Credit Needed: 670+

If you are a heavy spender, then this card might be the one for you! While transferring miles and points might not be allowed like the previous card, you can simply earn points by eating out or going to a supermarket/grocery store. An added plus is that there is an extremely user-friendly app.

Submit Your Review for This Travel Card

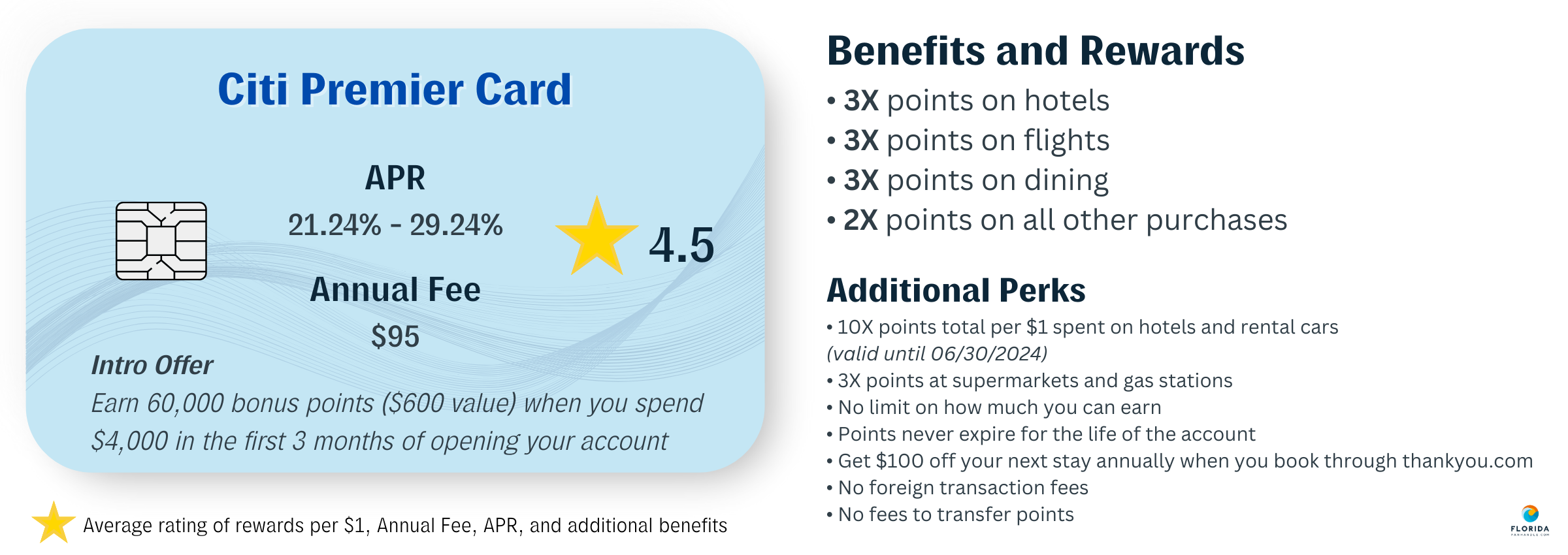

7. Citi Premier Card

Minimum Credit Needed: 670+

Earn more points when you get gas, eat out, or go to the grocery store. You get 3X points per dollar spent on any of these categories. You also get points when you spend money on hotels or flights, as well as frequent discounts and deals offered for a limited time.

Submit Your Review for This Travel Card

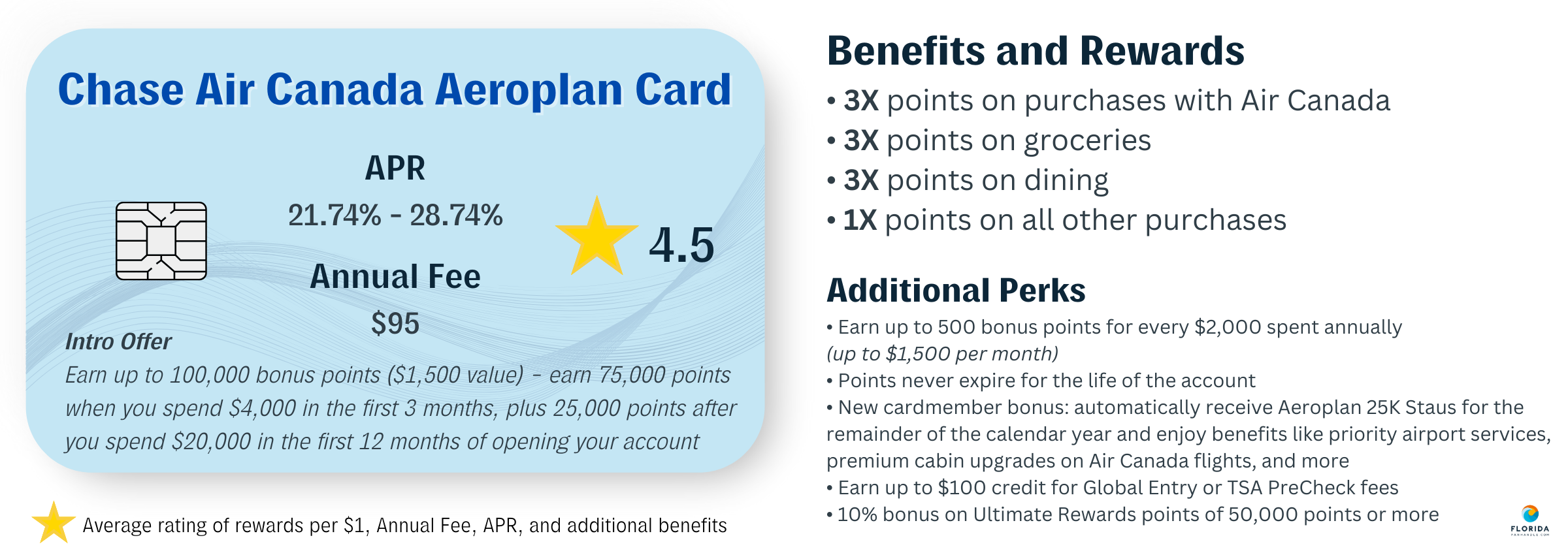

8. Chase Air Canada Aeroplan Card

Minimum Credit Needed: 670+

If you are an international traveler, then the Chase Air Canada Aeroplan Card could be the best card for you. Not only does it offer a new card member bonus as well as an intro offer, but you also get points on groceries and eating out. APR is average, but the annual fee is relatively low when comparing it against other card’s $200+ fees.

Submit Your Review for This Travel Card

9. The Business Platinum Card from American Express

Minimum Credit Needed: doesn’t claim a minimum

While there are higher than average membership fees for this card, it does have a great intro offer along with high rewards for spending. There are benefits like travel insurance, access to lounges worldwide, and rebates for CLEAR Plus & TSA.

Submit Your Review for This Travel Card

10. Capital One Spark 2X Miles for Business Card

Minimum Credit Needed: 640+

No membership fees for the first year is a great way to kick off your experience with Capital One Spark. This is one card available for small business owners. You can redeem rewards by transferring miles, there are no blackout dates, and there is travel insurance!

Submit Your Review for This Travel Card

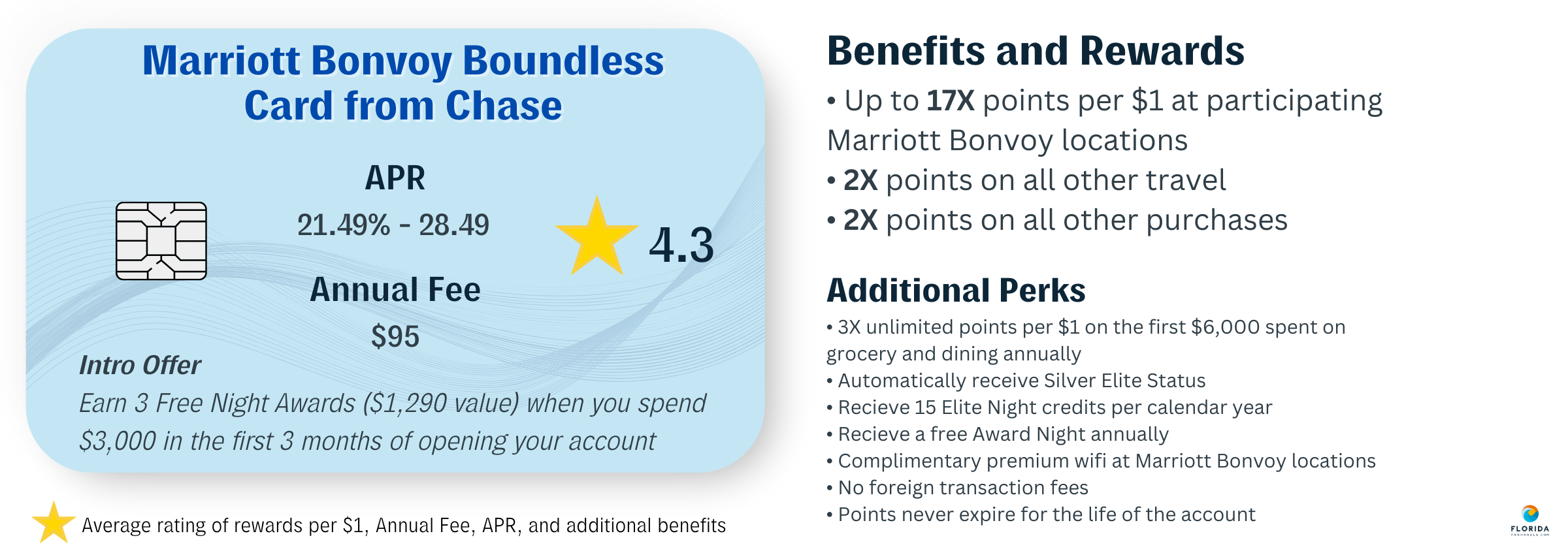

11. Marriott Bonvoy Boundless Card from Chase

Minimum Credit Needed: 690+

If you regularly stay at Mariott Bonvoy locations, then you could redeem free nights and bonus rewards. You get one free night per year, as well as rental car insurance and warranty protection. End-users claim it’s extremely easy to get points if you travel and shop frequently.

Submit Your Review for This Travel Card

12. United Explorer Card

Minimum Credit Needed: 670+

With a United Explorer Card, complimentary United Club passes, free priority boarding, and credit towards Global Entry, TSA Precheck, and NEXUS are all added benefits of getting this card. The app for this card is easy to use as well.

Submit Your Review for This Travel Card

13. Delta SkyMiles Gold American Express Card

Minimum Credit Needed: 670+

As you can probably tell in the name, Delta SkyMiles is very beneficial for those Delta flyers. You get free check bags, miles on eating out & groceries, priority boarding, and 20% back on inflight purchases. Not to forget to mention the free first year and lower than average annual fee.

Submit Your Review for This Travel Card

14. AAdvantage Executive World Elite Mastercard by Citi

Minimum Credit Needed: 670+

Interested in the Admiral’s Club airport lounge membership? Enjoy the luxury of an airport lounge when you have this card. You get high rewards with this card like free rental car insurance, trip insurance, and frequent promotions throughout the year.

Submit Your Review for This Travel Card

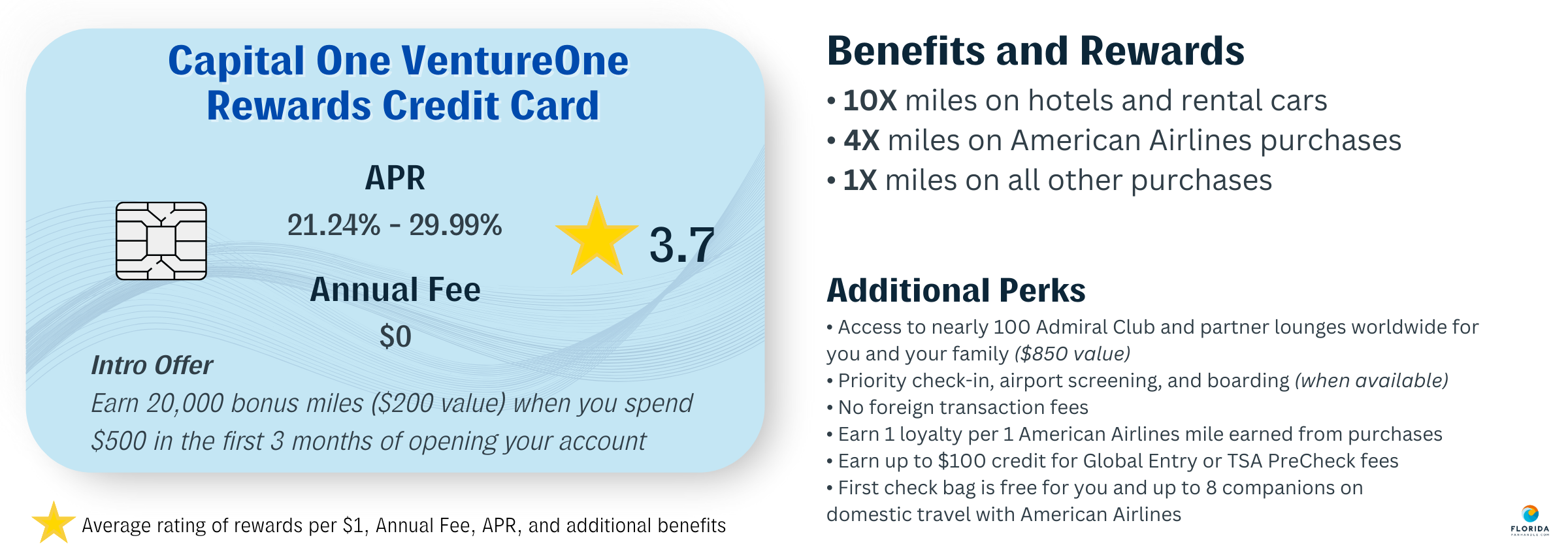

15. Capital One VentureOne Rewards Credit Card

Minimum Credit Needed: 700+

Transfer your miles, get extra miles for general purchases, and get travel insurance with the Capital One VentureOne Rewards Credit Card. While this card may not have all of the rewards that the Capital One Venture X card does, it still is a highly sought-after travel card and boasts big rewards for occasional travelers.

Submit Your Review for This Travel Card

20% of Consumers Have Applied for a Credit Card Within the Past Year

This is the year of credit cards and consumers realizing the benefits of travel credit cards specifically. “Travel Revenge” became increasingly popular in 2022, and the travel bug hasn’t quit since. People are constantly trying to find new ways to travel and new ways to save in order to travel more frequently.

In the past year alone, 20% of consumers have applied for a credit card in the past year… 34% stated that the inflation will make them use their credit card benefits even more than before.

This combination of high inflation, rising credit card applications, and the need to use travel benefits will make this travel season one that focuses primarily on travelers and how to get the best bang for their buck.

5 Tips for Using Credit Cards for Travel Benefits

1. Do your own research when it comes to rewards and loyalty programs

As always, there can be varying research methods and websites that give you a little something different. Make sure you look across multiple places to gauge whether or not a specific card would be the right fit for you.

2. Try out the different hotel programs that work well with your card

Not only do you want to get a good card that suits your needs, but you want to actually put the different programs to use. If you stay overnight frequently for business or leisurely trips, then it’s probably best to look into the different hotel rewards and programs that come with your card. Some hotels offer free nights while others are more of a loyalty reward point system.

3. Track your spending and rewards redeemed/gained

Knowing what you’re spending, what you have gained in rewards, and what you have previously redeemed is a great way to understand the need for a card and if it’s actually worth having it. Track everything and then take a look at it at the end of the year. This will help you understand what works for you and why it does.

4. Know your credit score before you apply for these travel credit cards

Don’t unknowingly apply for a credit card without knowing where your credit stand. This is because applications to new credit cards can harm your existing credit. There are several great apps and websites that help you find out your credit like Credit Karma or Experian.

5. Take advantage of the “easy” wins or easiest ways to gain points

Intro bonuses and offers, racking up rewards on eating out, gaining rewards from shopping…. all of these are “easy” wins for different types of travelers. Figure out your easiest wins and rack up points in any way that you can!

Using these tips, reviews, and rankings, we hope to inspire travelers everywhere to think considerably when getting the right travel card that suits their needs. These cards can help create a more seamless travel experience for everyone… if you use them correctly!

Methodology

FloridaPanhandle.com analyzed the most referred-to travel cards amongst several authoritative sources. Based on their value per $1, APR, and additional perks, we ranked the top 15.

To get the user reviews, we sifted through the top authoritative websites and took the average review percentage of those that rated each card highly vs poorly.